It’s you, and not your customer, who purchases the goods or services, which are supplied to and used by your business. They aren’t treated as disbursements for VAT purposes.Īny costs that your business incurs itself in the course of supplying goods or services to customers are not disbursements for VAT purposes. These could include travelling expenses and your own postage costs. “There are many incidental costs that your business might incur that you can’t exclude from the VAT calculation when you invoice your customers.

In other words you stayed in the hotel and you travelled on the train – not your client. In other words, if you recharge costs to your client you must charge VAT because the expense was for you, not for the client.

#Incurred expenses invoice plus

Why do I need to charge VAT on expenses?Įxpenses must be ‘recharged’ plus VAT at the rate at which your business charges it, i.e. If you are unsure if the treatment above applies to your circumstances, please get in contact to discuss. VAT can be complicated and the above is general guidance. For example, if you bill 100 miles at 45p you invoice will show £45.00 excl VAT on the mileage item of your invoice then at the bottom there will be £9 VAT. If you are billing at 45p per mile, VAT must be charged on top of this.

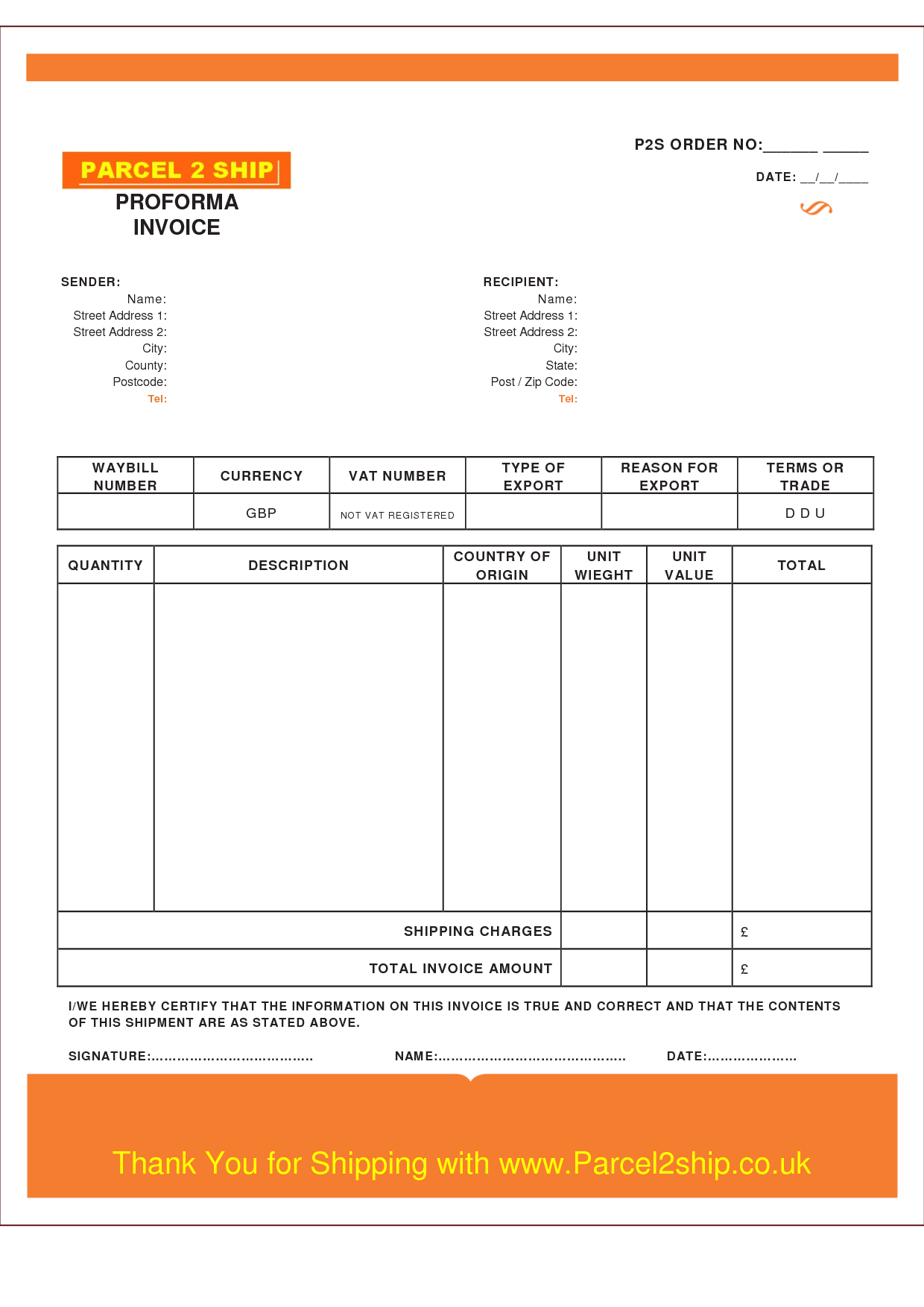

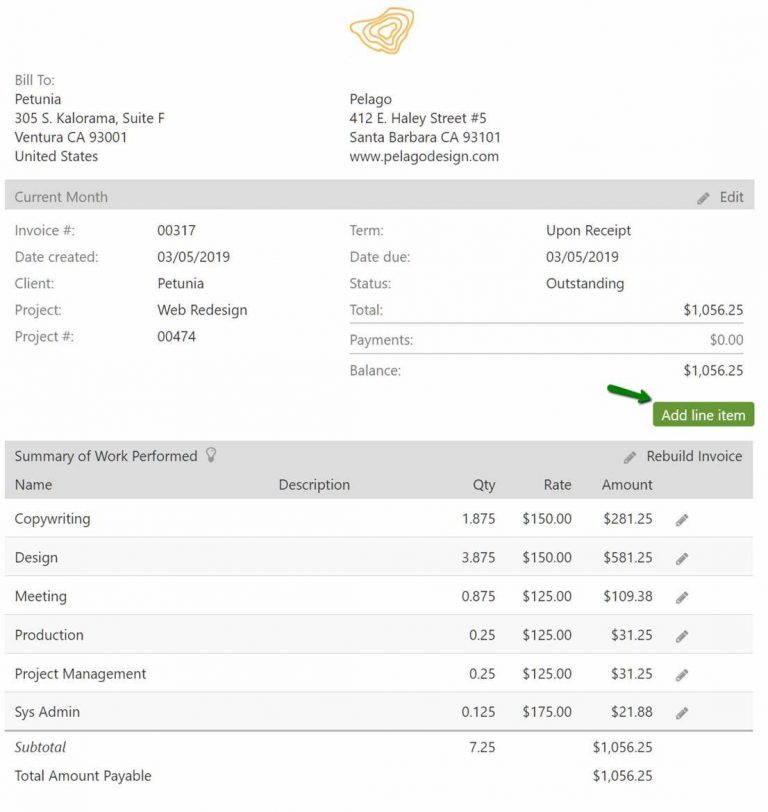

If the line on your invoice shows Exempt or Zero rated, click the pencil icon and change it to Standard (20.00%). If the expense originally was zero rated or exempt: ensure that VAT is applied to the expense on your invoice as you must charge VAT on that expense.You should check the VAT applied to your billed expenses: If you incurred VAT on the expense, you don’t charge it again. If you didn’t incur VAT on the expense, you charge VAT. In general VAT must always be charged but you must not charge VAT on top of VAT. Mileage – if you’ve negotiated a rate of 45p per mile with your client, you will charge for the number of mileage times the rate and you’ll add 20% VAT.Flights – VAT can be complicated on flights but generally they are zero rated. You charge your client what you paid but you will add 20% VAT.You charge your client what you paid but you will add 20% VAT. Train tickets – public transport is zero rated.You bill your client exactly what you paid which includes VAT. Hotel stays – normally standard rate VAT.Here are some common examples of expenses and their typical treatment of VAT when billing a client: If you are VAT registered you must ensure that VAT is charged on all your billable expenses, even if you did not incur VAT yourself. The same applies when billing mileage, select the ‘billable journey’ option. When you create your invoice you can click ‘Add invoice line’ then select ‘billable expense’ from here you will be able to select the expense you wish to bill your client for. This is to ensure later you invoice your client correctly for VAT. The best way to check this is to refer to your receipt. When you enter the expense in the Quick Entry area or Bookkeeping, you must select the exact VAT rate incurred on the expense.

0 kommentar(er)

0 kommentar(er)